IntegrityStar, March 2021 edition

by Tina Maier, CPA, CFE, CIG, Associate Director University Audit

If you recall in the last edition of the IntegrityStar, I introduced Part 1 of questions to ask yourself that focused on approving vendor invoices. For this edition (Part 2) I will share some questions to ask yourself before approving procurement card (Pcard) purchases. Then stay tuned for Part 3 in the next edition that will highlight questions for travel reimbursements.

We all know that Pcards are convenient and an efficient means of making purchases for departmental or research needs. The use of Pcards at the university has expanded over the past few years. Unfortunately, this convenience and ease of use comes with increased risk of fraudulent purchases. Nowadays with much of everything being electronic, it is easy for a fraudster to submit a fake or altered receipt and not so easy for the Pcard approver to notice when a receipt might be fake. The risk of a fraudulent purchase going undetected is even greater when the approver falls victim to the rubber-stamping syndrome as mentioned in Part 1, especially when a department or an employee has numerous Pcard transactions.

A case of Pcard fraud that occurred at the university several years ago involved returning purchases for store credit. Here is how it worked, an employee used their Pcard to purchase a routine departmental item on Amazon, such as books for a faculty member. Amazon issued a receipt for the book purchase, which the employee then submitted to the Pcard processor and approver as support for the purchase. On the same day, or within a day or two, the employee cancelled the purchase and opted to receive an Amazon “store” credit in their own name, instead of processing a refund back to the Pcard as required by the Pcard Office. The employee then used the Amazon credit to purchase personal items for their own use.

As a result of this Pcard fraud, the Pcard Office now runs a query to examine Level III merchant data that shows an audit trail of each transaction. Level III merchant data is additional transactional data provided by a vendor, but not all vendors provide this data to the university or have it available.

Ok so this type of Pcard fraud is hard for anyone to detect, but there are resources available that can help you identify fraudulent transactions. One method is to run the PeopleSoft query FXPO_PCARD_DETAILS_BY_DPT_PROG, which provides transactional Level III Merchant data by department.

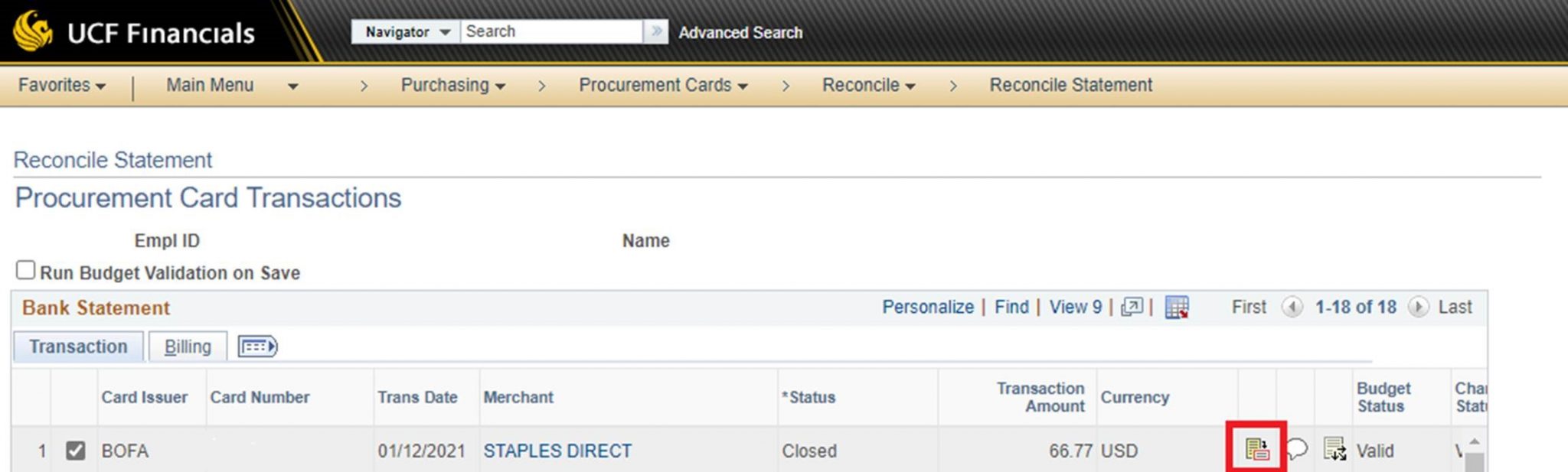

Another way to review Level III Merchant data is through the Reconcile Statement page in PeopleSoft. Go to Reconcile Statement and click the icon outlined with the red box depicted in the below screen shot, then compare the data provided by the vendor with receipts submitted by the Pcard holder. This feature is highlighted in the Pcard training course FP0232 and the PCard office plans to offer two virtual training sessions this year.

To help prevent fraud on your watch, please take a few moments to ask yourself these questions before approving Pcard purchases electronically in PeopleSoft or signing off on receipts to be processed:

-

- What is the business purpose of the Pcard charge? Is it reasonable for the person making the purchase?

- Is the expense allowable under the university’s policies and fund use guidelines?

- Are the costs claimed ‘reasonable’ considering the department’s organizational structure, culture, policy, and location?

- Does the receipt show the name, address, and phone number of the vendor?

- Were any costs split into multiple purchases to avoid the allowable maximum on the Pcard?

- Was the item returned for store credit? Spot check transactions, especially for purchases made by employees on behalf of other employees, by reviewing Level III Merchant data through the Reconcile Statement page in PeopleSoft or by running the PeopleSoft query FXPO_PCARD_DETAILS_BY_DPT_ PROJ.

- Could the item purchased be used in the home, is easily transported, or a desirable item? If so, consider verifying the physical location of item.

- Is the P-Card spending in line with the supervisor’s expectations and outlined budget?

- Was the purchase date or time unusual and/or not within normal business hours of the department? For example, purchases made on weekends, evenings or just prior to a holiday should put you on alert for a fraudulent transaction.